941 Quarterly Tax Form 2024

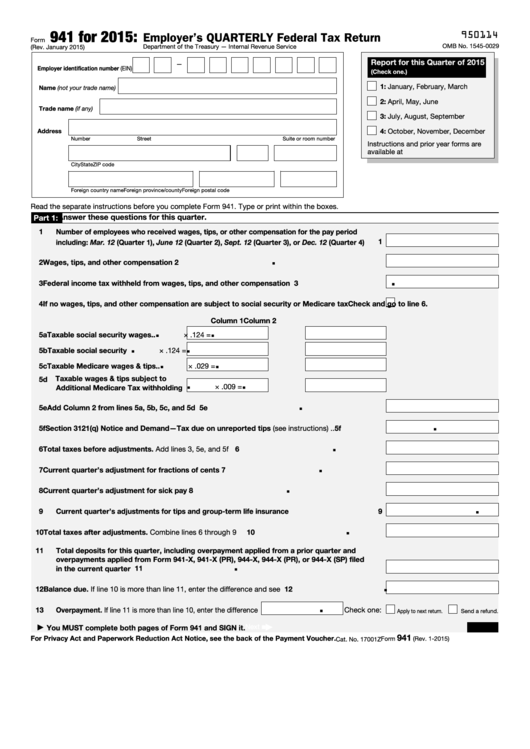

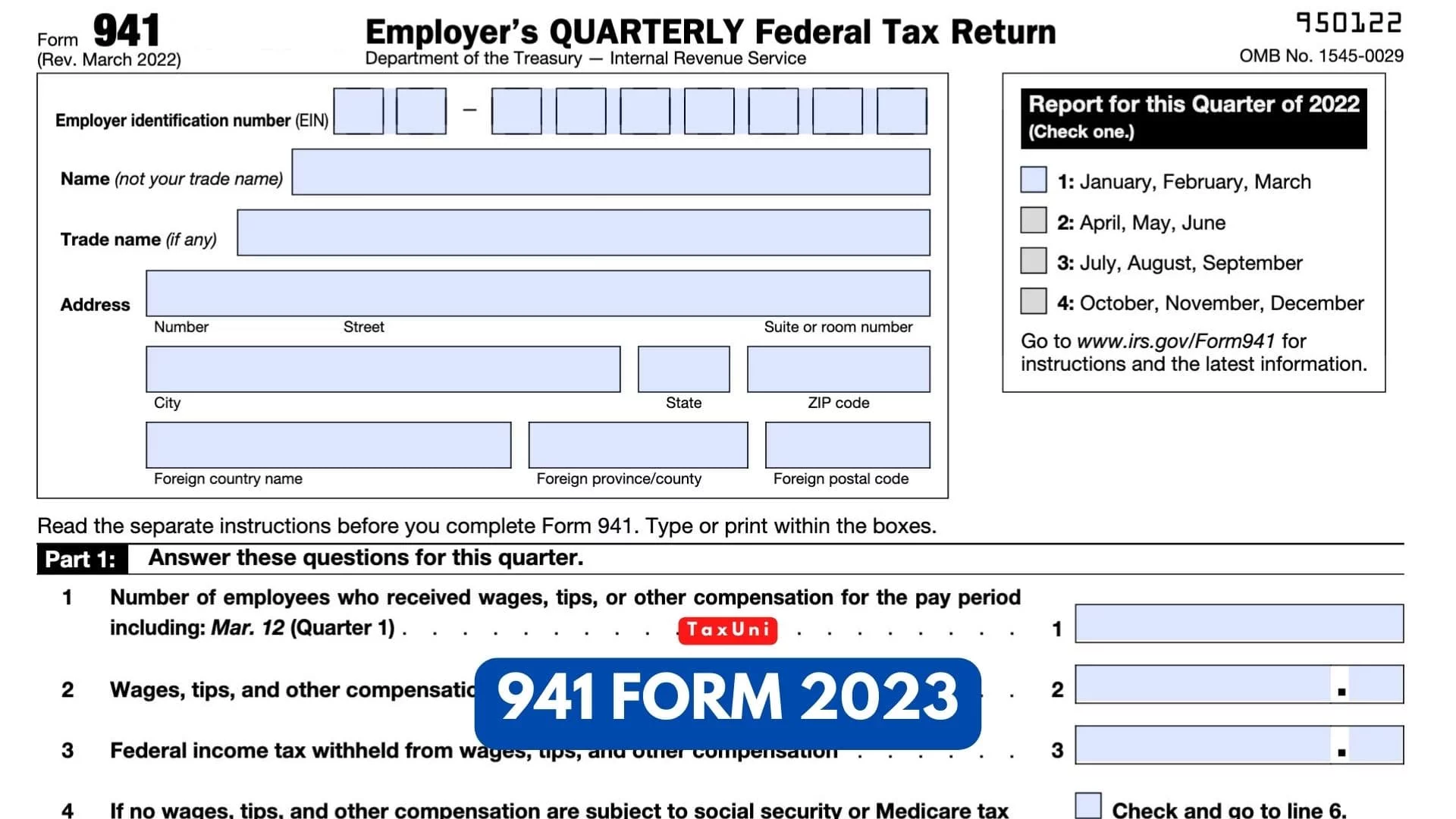

941 Quarterly Tax Form 2024. The irs finalized form 941 and all schedules and instructions for 2024. Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs.

These instructions tell you about schedule b. Form 941 is used by organizations that wish to file their payroll and income tax returns quarterly.

Federal Law Requires You, As An Employer, To Withhold Certain Taxes From Your Employees’ Pay.

If you’re an employer who pays wages and compensation that are subject to federal tax withholding or payroll taxes, then you may need to report wages and withheld taxes on irs form 941, employer’s quarterly federal tax return.

Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Final versions of the quarterly federal employment tax return for use in 2024, its schedules, and instructions were released feb.

941 Quarterly Tax Form 2024 Images References :

Source: dauneyalonda.pages.dev

Source: dauneyalonda.pages.dev

941 For 2024 Printable Sonni Cinnamon, Form 941 is a quarterly tax form that tracks federal insurance contributions act (fica) (social security and medicare) payments made by employers throughout the year. The revision is planned to be used for all four quarters.

Source: www.printableform.net

Source: www.printableform.net

Printable 941 Quarterly Form Printable Form 2024, To determine if you’re a semiweekly schedule depositor, see section 11 of pub. 19 jul 2024, 05:53:25 pm ist ts eamcet 2024 counselling result live:

Source: walliwwalvina.pages.dev

Source: walliwwalvina.pages.dev

Irs Releases 2024 Form 941 Cynde Rodina, Form 941 is a quarterly tax form that tracks federal insurance contributions act (fica) (social security and medicare) payments made by employers throughout the year. Quarterly federal tax form 941 for the second quarter ending june 30, 2024.

Source: phoebewbarby.pages.dev

Source: phoebewbarby.pages.dev

941 For 2024 Fillable Form Sara Wilone, Noninterest expenses were € 6.7 billion in the second quarter, up from € 5.6 billion in the second quarter of 2023, or € 5.4 billion excluding the postbank litigation provision, 4% lower than. The irs form 941, employer’s quarterly federal tax return, used by businesses to report information about taxes withheld such as federal income, fica taxes, and additional tax medicare tax withheld from the employee wages with the equivalent employer contribution.

Source: www.uslegalforms.com

Source: www.uslegalforms.com

Print Irs Form 941 Fill and Sign Printable Template Online US Legal, Verify if the form 941 is set to quarterly. Irs form 941, employer’s quarterly federal tax return, is used by employers to report income and payroll tax withholdings, social security, and medicare tax burden.

Source: shariawreba.pages.dev

Source: shariawreba.pages.dev

When Are Quarterly 941 Taxes Due 2024 Malva Rozalin, Section references are to the internal revenue code unless otherwise noted. The deadline for wages paid in april, may, and june is july 31, 2024.

Source: minniewpaula.pages.dev

Source: minniewpaula.pages.dev

Federal Form 941 For 2024 Lotty Riannon, Form 941 is due by the final day of the month after a quarter ends: 26 by the internal revenue service.

Source: oforms.onlyoffice.com

Source: oforms.onlyoffice.com

Form 941 template ONLYOFFICE, The form 941 will be automatically updated in quickbooks through payroll tax table updates. Form 941 is used by organizations that wish to file their payroll and income tax returns quarterly.

Source: fincent.com

Source: fincent.com

Guide to IRS Form 941 Quarterly Federal Tax Return, 26 by the internal revenue service. The form 941 will be automatically updated in quickbooks through payroll tax table updates.

Source: nicolettezbrooks.pages.dev

Source: nicolettezbrooks.pages.dev

Irs Form 941 Schedule B 2024 Kore Shaine, All employers or business proprietors paying wages to workers are obliged to file the irs tax form 941 every quarter. You are exempted from filing form 941 if you are a:

You Must File Form 941 Unless You:

Organizations have until january 31 to submit this form, so the due date for reporting 2023 unemployment taxes, is january 31, 2024.

The Form 941 Will Be Automatically Updated In Quickbooks Through Payroll Tax Table Updates.

26 by the internal revenue service.

Posted in 2024